报告主题:FinTech Lending with LowTech Pricing

Abstract:FinTech lending-known for using big data and advanced technologies-promised to break away from the traditional credit scoring andpricing models. Using a comprehensive dataset of FinTech personaloans, our study shows that loan rates continue to rely heavily on conventional credit scores, including 45% higher rates for nonprime borrowers.Other known default predictors are often neglected. Within each segment(prime/nonprime) loan rates arc not very responsive to default risk, result-ing in realized loan-level returns decrcasing with risk. The pricing distor-tions result in substantial transfers from nonprime to prime borrowers andfrom low- to high-risk borrowers within segment.

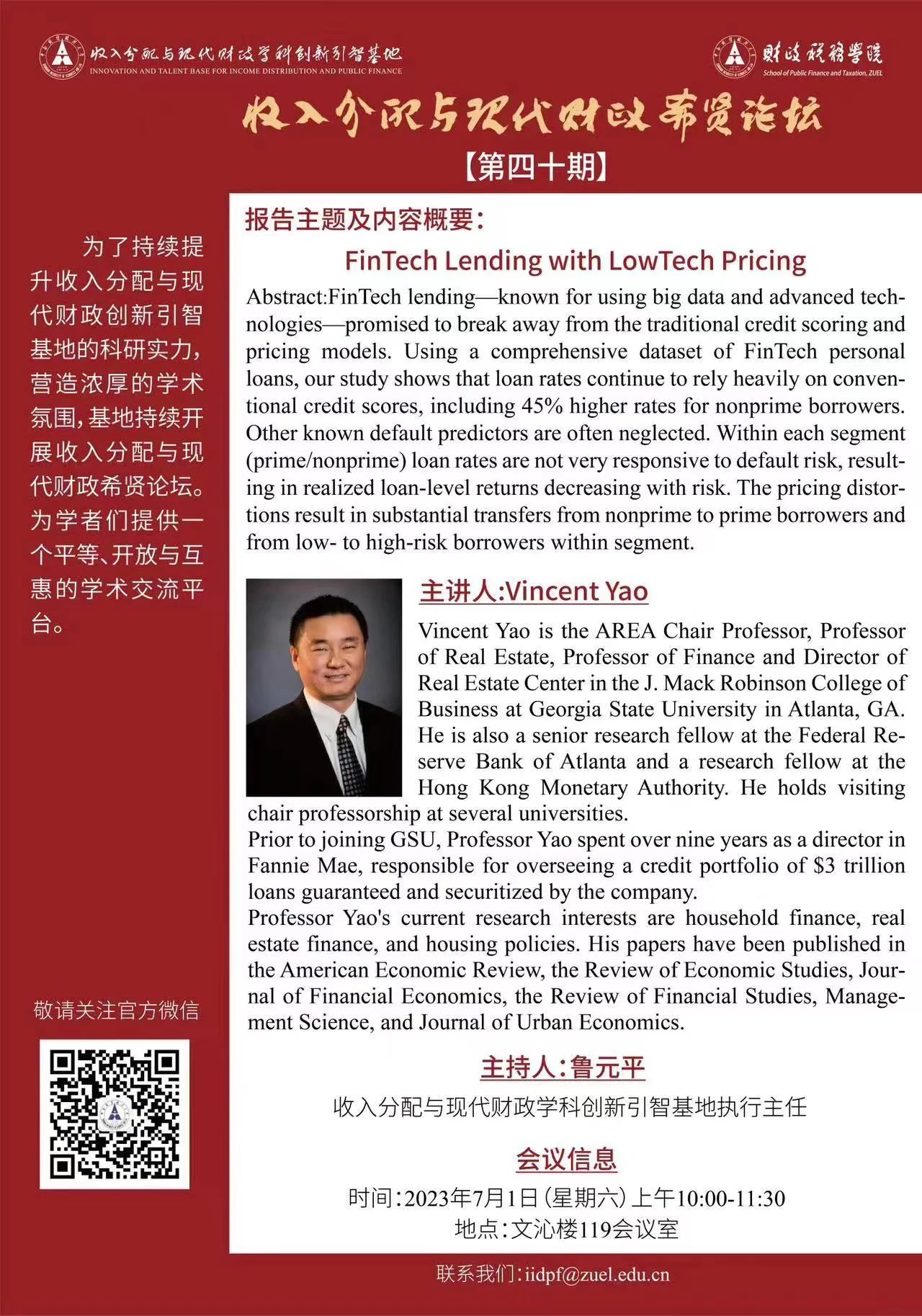

主讲人简介:Vincent Yao

Vincent Yao is the AREA Chair Professor, Professorof Real Estate, Professor of Finance and Director ofReal Estate Center in the J. Mack Robinson College ofBusiness at Georgia State University in Atlanta, GA.He is also a senior research fellow at the Federal Re-serve Bank of Atlanta and a research fellow at theHong Kong Monetary Authority. He holds visitingchair professorship at several universities.Prior to joining GSU, Professor Yao spent over nine years as a director inFannie Mae, responsible for overseeing a credit portfolio of $3 trillionloans guaranteed and securitized by the company.Professor Yao's current research interests are household finance, realestate finance, and housing policies. His papers have been published inthe American Economic Review, the Review of Economic Studies, Jour-nal of Financial Economics, the Review of Financial Studies, Management Science, and Journal of Urban Economics.

时间:2023年7月1日(星期六)10:00-11:30

主持人:鲁元平

收入分配与现代财政学科创新引智基地执行主任

地点:文沁楼119会议室