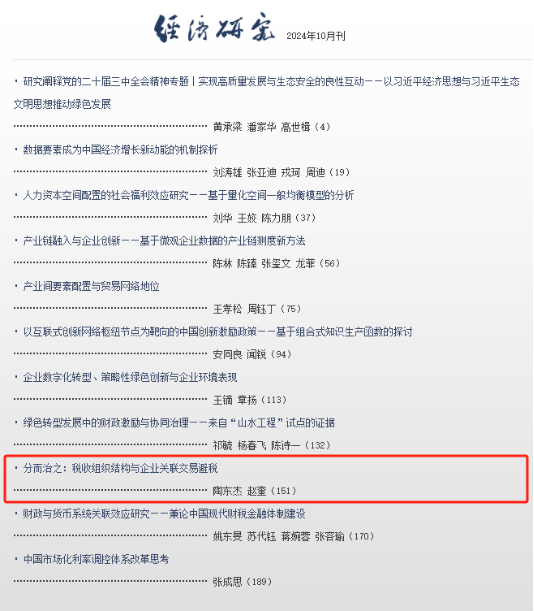

Associate Professor Tao Dongjie, Deputy Director (temporary position) of the Center for International Cooperation and Disciplinary Innovation of Income Distribution and Public Finance (111 Center) of Zhongnan University of Economics and Law (ZUEL) and Vice Dean of the School of Finance and Public Administration of Hubei University Economics (HBUE), has recently published his collaborative paper, which is titled "Divide and Rule: Tax Organizational Structure and Tax Avoidance through Corporate Related-party Transactions", in the 10th issue of the top Chinese journal Economic Research Journal in 2024. Tao Dongjie is a mid-level cadre under the Qiaochu (outstanding talent) Program of the Organization Department of the CPC Hubei Provincial Committee, and has been taking a temporary position as the Deputy Director of the 111 Center for a one-year term since September 2024. During his tenure, Tao Dongjie has been actively participating in various academic exchanges and international cooperation activities at the center. The achievement of this research outcome is an important symbol of the center’s role in leveraging high-level discipline construction to promote the development of local universities, which also embodies the paired-up support and cooperation between ZUEL and HBUE.

Abstract

This paper uses the establishment of the six special commissioner's offices of the State Taxation Administration in two batches in 2017 and 2019 as a quasi-natural experiment. Based on a large sample dataset of related-party transactions between non-financial companies listed in the A-share market from 2015 to 2021 and their parent and subsidiary companies, the paper employs a difference-in-differences method to analyze the governance effect of optimizing tax organizational structure on tax avoidance through related-party transactions in corporate groups. The study finds that the establishment of the special commissioner's offices has enhanced the efficiency of cross-regional tax audit organizations through improved management capabilities, effectively curbing tax avoidance through related-party transactions in corporate groups. Moreover, this effect is more pronounced for private companies and those with a higher shareholding ratio in affiliated companies, which exhibit stronger motivations for tax avoidance. Mechanism analysis reveals that the establishment of special commissioner's offices has effectively restrained corporate groups from utilizing differences in effective tax rates between parent and subsidiary companies to engage in tax avoidance through related-party transactions, such as by leveraging tax incentives for high-tech enterprises, tax benefits for small and micro enterprises, and tax carryover policies for loss-making companies. Further analysis indicates that the establishment of special commissioner's offices has significantly enhanced local tax capacity. This paper provides the first evaluation of the organizational performance of the special commissioner's offices of the State Taxation Administration and offers policy implications for tax authorities to enhance their taxation capabilities by optimizing the organizational structure.

About the Author

Tao Dongjie, obtaining his Ph.D. in Management from Huazhong University of Science and Technology, now serves as the Vice Dean of the School of Finance and Public Administration and Director of the MPA Center at HBUE. He is an associate professor and master's supervisor, with primary research focused on tax theories and policies. He has published over 30 papers in domestic and international journals, including Economic Research Journal, Journal of Quantitative & Technical Economics, Economic Science, and China Economic Review. He has presided over many projects, including Young Scientists Fund projects of the National Natural Science Foundation of China and Youth Fund projects of the Humanities and Social Sciences Research Program of the Ministry of Education. His academic achievements have been recognized with a third prize of the Social Science Outstanding Achievement Award in Hubei Province and a first prize of the Chinese Tax Institute's Tax Research Outstanding Achievement Award. He has repeatedly been awarded titles such as Excellent Undergraduate Tutor, Outstanding CPC Member, and Advanced Head Teacher at HBUE. He is also a backbone teacher in the construction of national first-class programs and courses in Finance.