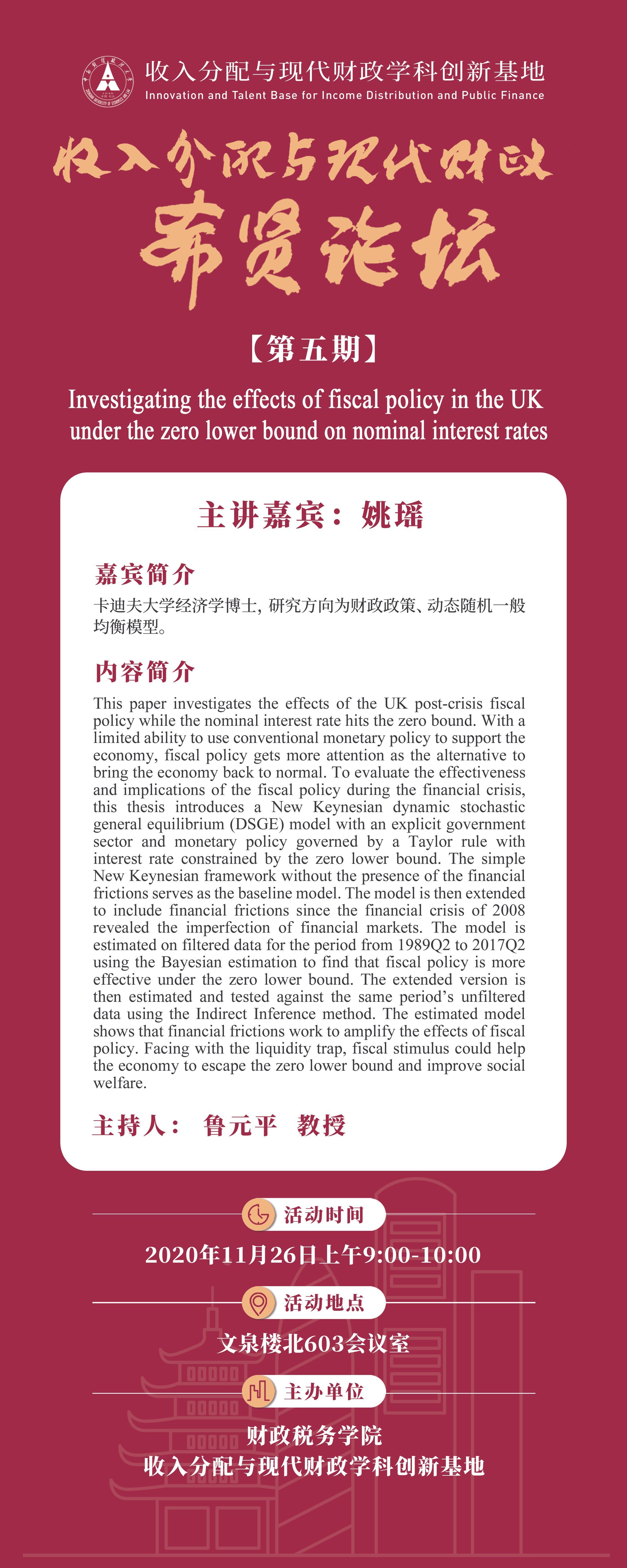

Topic: Investigating the effects of fiscal policy in the UK under the zero lower bound on nominal interest rates

Time: 9-10 a.m. Nov 26, 2020

Venue: Conference Room 603, the North Wing of Wenquan Building

Host: Professor Lu Yuanping

Guest Speaker: Yao Yao

Ph.D. in Economics of Cardiff University, with research interests in fiscal policy, dynamic stochastic general equilibrium models

Introduction:

This paper investigates the effects of the UK post-crisis fiscal policy while the nominal interest rate hits the zero bound. With a limited ability to use conventional monetary policy to support the economy, fiscal policy gets more attention as the alternative bring the economy back to normal. To evaluate the effectiveness and implications of the fiscal policy during the financial crisis, this thesis introduces a New Keynesian dynamic stochastic general equilibrium (DSGE) model with an explicit government sector and monetary policy governed by a Taylor rule with interest rate constrained by the zero lower bound. The simple New Keynesian framework without the presence of the financial frictions serves as the baseline model. The model is then extended to include financial frictions since the financial crisis of 2008 revealed the imperfection of financial markets. The model is estimated on filtered data for the period from 1989Q2 to 2017Q2 using the Bayesian estimation to find that fiscal policy is more effective under the zero lower bound. The extended version is then estimated and tested against the same period’s unfiltered data using the Indirect Inference method. The estimated model shows that financial frictions work to amplify the effects of fiscal policy. Facing with the liquidity trap, fiscal stimulus could help the economy to escape the zero lower bound and improve social welfare.