At 2:30 p.m. on October 23, 2018, the "Series Academic Reports by Famous Experts for Anniversary Celebration", hosted by the School of Public Finance and Taxation and Institute of Income Distribution and Public Finance of Zhongnan University of Economics and Law, was successfully held in conference room 403, North of Wenquan Building. Austrian economist Friedrich Schneider brought an academic lecture entitled "Shadow Economies Around the World: What Did We Learn over the Last 20 Years? – Latest Results for China, India, Russia and Vietnam" to teachers and students of our school. The lecture was presided over by teacher Sun Qunli of the School of Finance and Taxation.

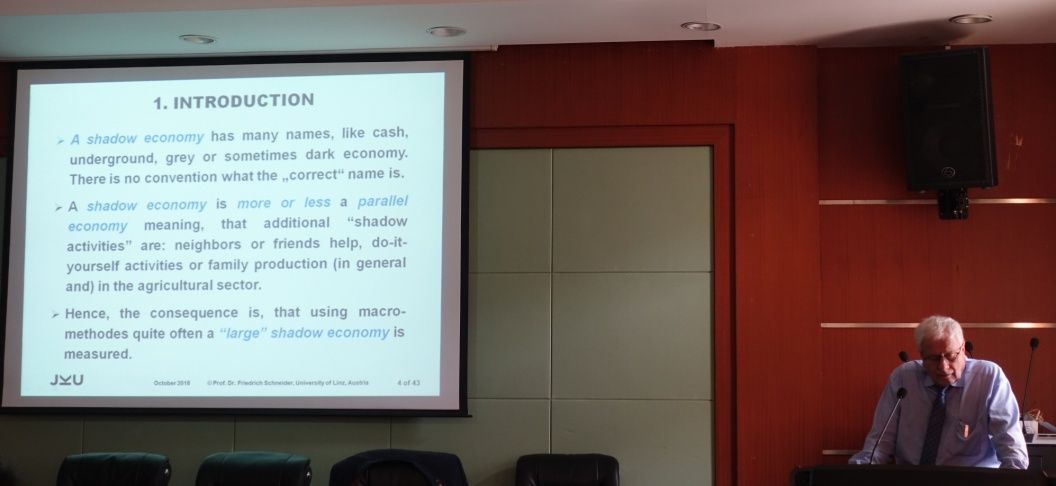

Professor Schneider first introduced the concept of the underground economy and its causes, then made a theoretical analysis of the underground economy and tax evasion, pointing out that the scale of the underground economy and tax evasion were mainly determined by the restriction of laws and regulations, public sector services, tax burden and social security payment burden, as well other factors.

Professor Schneider further introduced three estimation methods of the underground economic scale. The first was a direct method of using micro-level data to determine the scale of the underground economy. This approach was usually achieved by investigating and calculating discrepancies in national accounts. Then Professor Schneider introduced an indirect method of using macroeconomic indicators to replace the development of the underground economy: The money Demand Method. A method called MIMIC (Multiple Indicators, Multiple Causes) was also introduced, which used statistical tools to estimate the underground economy as an "unobserved" or "potential" variable. Next, Professor Schneider specifically explained how to use these methods to make simulated macro estimates of the underground economy in many countries around the world, and compared them with the simulated adjusted countries to critically explore the rationality of these estimates. At the same time, according to the empirical results obtained by these methods, Professor Schneider also demonstrated the scale and development of underground economy in 154 countries in the world, with exception of China, India, Russia and Vietnam.

After that, Professor Schneider proposed policy measures to cut back the underground economy. The first part was a general statement of policy measures: if policymakers succeeded in transforming underground economic activities into an official economy, then a decline in the underground economy would only increase the overall welfare of each country. Policymakers must therefore support and choose such policy measures to strongly increase the incentive to shift production from the underground to the official sector. In the second part, six detailed policy measures to combat the underground economy and tax evasion were introduced: Firstly, governments could control unemployment through economic policies, or try to improve the country's competitiveness to increase foreign demand. Secondly, governments could deregulate the economy or encourage residents to "be their entrepreneurs", making it easier to start their businesses, thereby reducing unemployment and contributing positively to the control of the size of the underground economy. Thirdly, the previous two policy measures needed to boost trust in public institutions at the same time, to reduce the likelihood of self-employed individuals converting a reasonable proportion of their economic activities into an underground economy. Once it happened, the effectiveness of government policies to encourage self-employment would be impaired; Fourthly, in addition to these measures, policymakers should also focus on reducing overall tax revenues (especially indirect taxes and tariffs); Fifthly, the quality of institutions was equally important, that is, through establishing democratic and transparent institutions that reduce regulation burden, corruption and bureaucracy, public's trust and confidence in public institutions could be restored; Sixthly, governments should simplify licensing procedures, speed up the issuance of documents needed to start a business, reduce bureaucratic barriers to issue such documents, improve transparency in the whole process and cut down the administrative burden on enterprises.

After the report, Professor Schneider answered questions raised by the teachers and students one by one. Mr. Sun Qunli summarized the lecture and thanked the teachers and students present and Professor Schneider. This rich and vivid lecture was of great significance to the teachers and students of our school, which broadened their research vision, enriched their research knowledge and improved their research ability. As far, the report was successfully concluded.