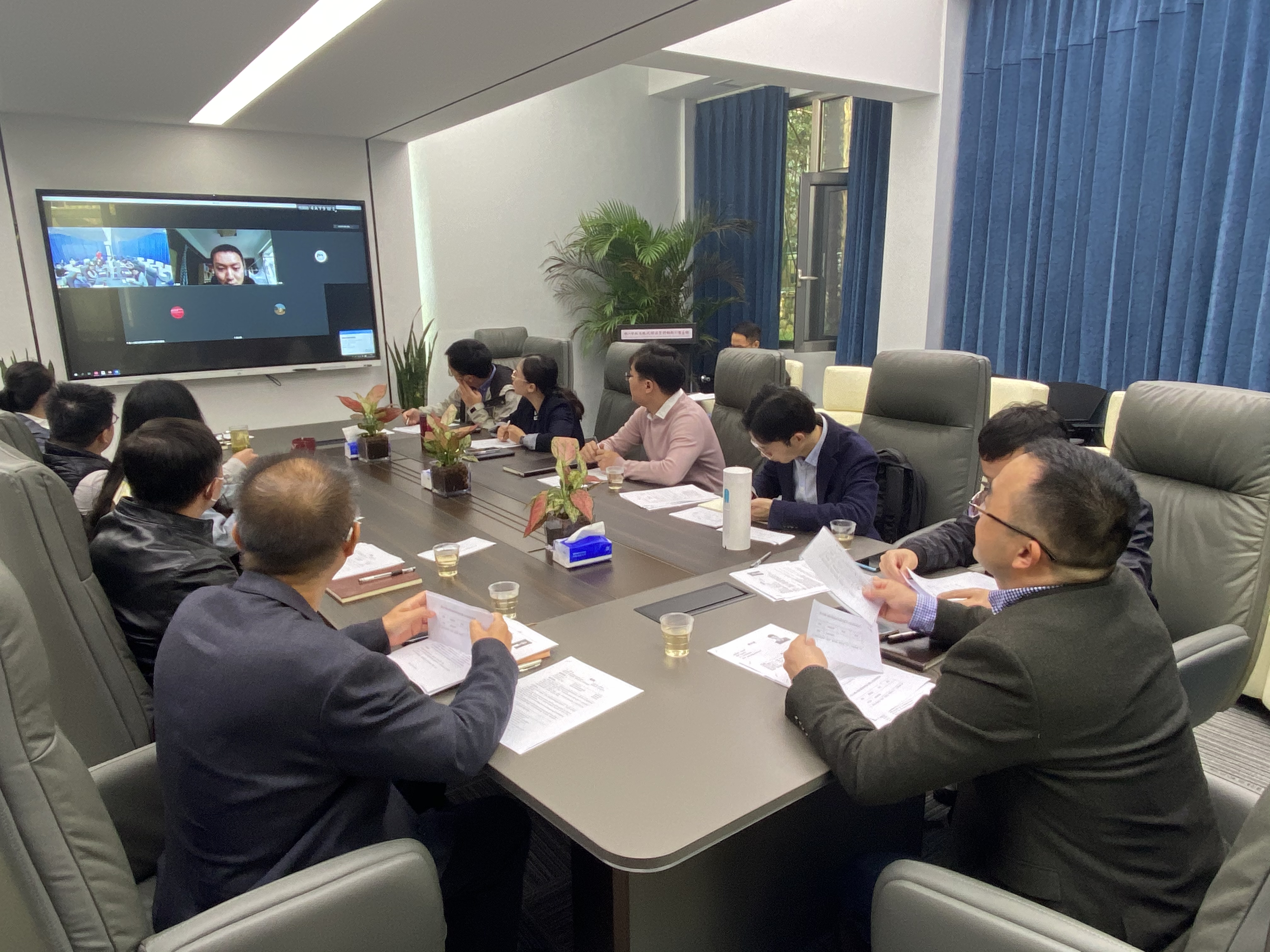

On 28 October 2021, the 17th to 20th Xi Xian Forum on Income Distribution and Public Finance, co-organized by IIDPF and the School of Public Finance and Taxation of ZUEL, was successfully held in Conference Room 119 of Wenqin Building. Dr Ge Run from Tsinghua University, Dr Kou Xuan from Southwest University of Finance and Economics, Dr Li Zheng Yang, jointly trained by Southwest University of Finance and Economics and National University of Singapore, and Dr Tao Yunqing from Zhongnan University of Economics and Law were invited to deliver keynote speeches on "How the Comprehensive Two-Child Policy Affects Families' Second-Child Birth Decisions", "Analysis of the Pro-Poor and Moderating Effects of Taxation", "Education Choice, Entrepreneurial Behaviour and Gender Income Gap" and "The Sky is the Limit: Information Infrastructure Development and Corporate Investment" respectively as the keynote speakers of the 17th to 20th Xi Xian Forum. The forum was chaired by Professor Lu Yuanping, Executive Director of IIDPF, and was attended by more than 20 students and faculty members, including Professor Sun Qunli, Deputy Director of the Base, Professor Li Rui from the School of Public Administration, Dr Zhou Qiang from the School of Economics, and all researchers of the Base, through online and offline hybrid means.

Dr Ge Run's presentation focused on explaining and discussing the impact of the comprehensive two-child policy on families' fertility decisions in the context of the implementation of China's comprehensive two-child policy in 2016. He elaborated on four aspects of the study: motivation, theoretical model, data analysis and research findings. Using an empirical analysis of CFPS panel data from 2010-2018 using the double difference method, Dr Ge Run concluded that the implementation of the comprehensive two-child policy significantly increased the likelihood of households having a second child. The analysis found that this policy had a significant impact particularly on families living with their parents and on families with a kindergarten in the community. In the meantime, based on estimates of the full two-child policy, Dr Ge Run also projected the effects of further liberalisation of birth restrictions and the implementation of a three-child policy, providing forward-looking empirical evidence for judging China's future demographic situation.

As an important means of fiscal redistribution, taxation plays an important role in narrowing the income distribution gap. In his subsequent presentation, Dr Kou Xuan focused on the distribution of taxation, the impact of taxation on relative poverty, and the regulatory role of taxation in income distribution. Based on the CFPS and the fiscal data in the China Statistical Yearbook, she found in her research that indirect taxes are "pro-rich", corporate income taxes are "neutral" and personal taxes are "pro-poor", using the tax pro-poorness index, the Gini coefficient and its source composition decomposition measures. Further decomposition of this finding reveals that individual taxes and fees have a positive moderating effect on income inequality, moderating it to some extent; indirect taxes have an inverse moderating effect on aggregate consumption inequality.

In the following, Dr Li Zhengyang comprehensively examined the impact of years of education and entrepreneurial behaviour on the gender income gap in the context of the current problem of unbalanced and insufficient female development in China, using CHIP data from 1995-2013 as the basis of her research. She concludes through empirical analysis that the gender income gap in China as a whole tends to widen, and finds that years of schooling explain more strongly the gender income gap, that opportunistic entrepreneurship explains more strongly each year, and that the impact of opportunistic entrepreneurship at the higher quartile is increasingly non-negligible. Dr Li's research provides a possible explanation for the formation of the gender income gap at the high quartile and identifies opportunistic entrepreneurship as an important explanatory factor at the high quartile, providing a theoretical basis for reducing the gender income gap in China.

Using the State Council's Circular on the Issuance of the "Broadband China" Strategy and Implementation Plan issued in 2013 as a blueprint, Dr Tao Yunqing examines the impact of broadband access on enterprises' investment behaviour, and fundamentally explores how the construction of information infrastructure affects the behavioural decisions of micro-entities. The study found that the Broadband China pilot policy significantly increased the level of corporate investment, with the greater the incentive for corporate investment among enterprises with higher government subsidies, enterprises with higher financing constraints and manufacturing enterprises. This finding fully highlights the importance of information infrastructure development. Dr Tao Yunqing's research findings systematically assess the impact of China's information infrastructure development on micro enterprise investment, finding that upgrading information infrastructure is conducive to enabling enterprise investment and investment efficiency, providing a factual basis for the positive effects of China's digital economy and the effectiveness of the "Broadband China" pilot policy.

The speeches of the four guest speakers demonstrated their solid academic skills and aroused the interest and resonance of the students and faculty present. During the interactive session, faculty members had in-depth discussions with the keynote speakers on issues such as control variables, placebo tests and selectivity bias in empirical studies. The forum was successfully concluded.