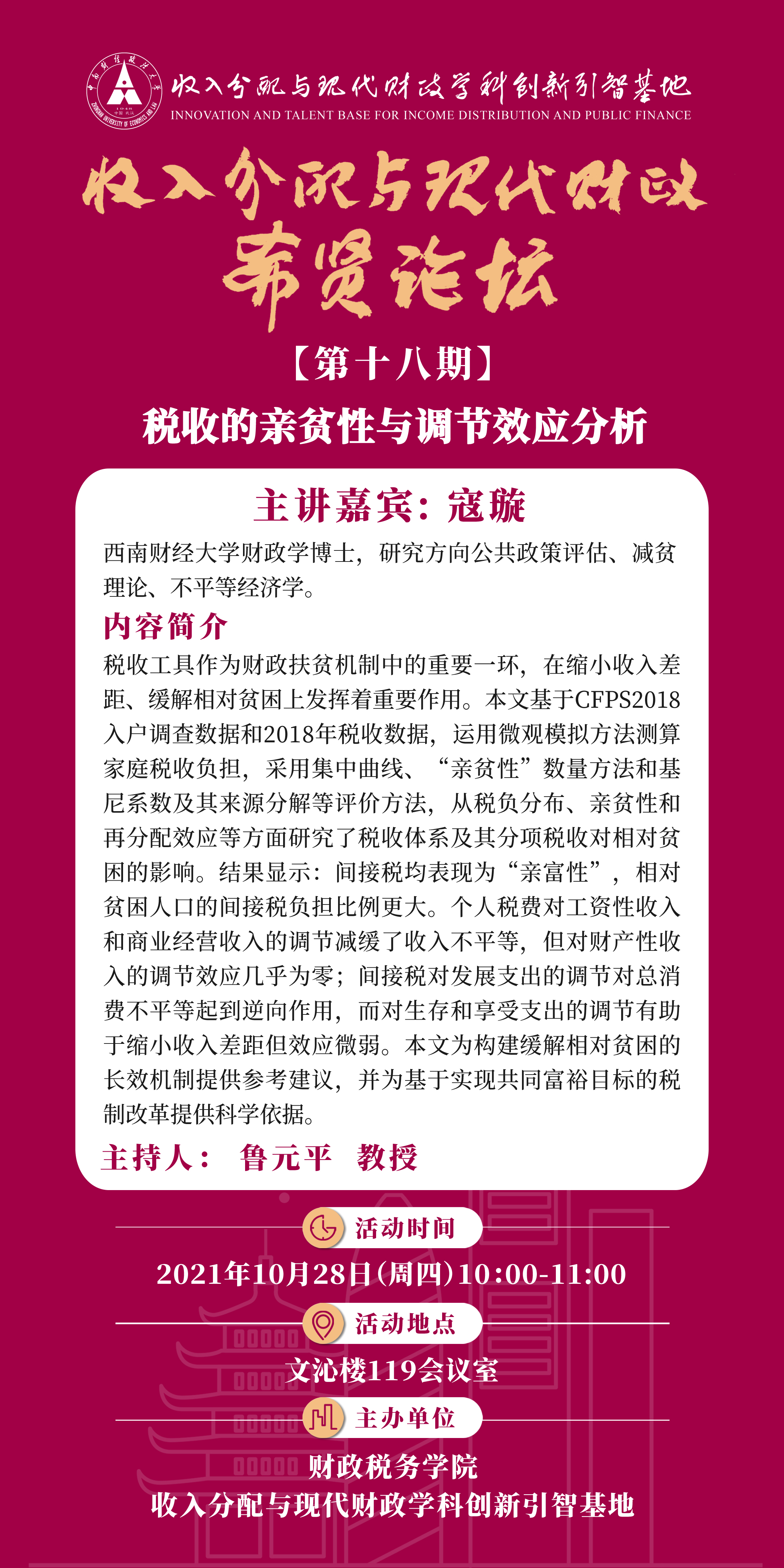

Title of Lecture: Analysis of the Pro-Poor and Regulatory Effects of Taxation

Time: 10:00am - 11:00am, 28 October 2021

Venue: Conference Room 119, Wenqin Building

Moderator: Prof. Lu Yuanping

Guest Speaker: Kou Xuan

PhD in Finance, Southwest University of Finance and Economics

Abstract:

Taxation instruments, as an important part of the financial poverty alleviation mechanism, play an important role in reducing income disparity and alleviating relative poverty. Based on CFPS 2018 household survey data and 2018 tax data, this paper uses micro-simulation methods to measure household tax burdens, and employs evaluation methods such as concentration curves, quantitative methods of "pro-poor" and decomposition of the Gini coefficient and its sources to study the tax system and its results have shown that indirect taxes are all "pro-rich", with a greater proportion of the burden of indirect taxes falling on the relatively poor. The effect of individual taxes on wage income and business income reduces income inequality, but the effect of indirect taxes on property income is almost zero. This paper provides suggestions for the construction of a long-term mechanism to alleviate relative poverty and scientific evidence for tax reform based on the goal of achieving common prosperity.