Report topic:Emission Trading Scheme and Cross-border Mergerand Acquisitions

Abstract:Emission trading schemes (ETS) provides a manket mechanism to mitigate carbon emissions and has been introduced in many countries across the world. The fundamental idea of an ETS is to make carbon emission costly. As a consequence, firms undertaking cross-border expansions may have to take this extra cost into consideration when entering a market with ETS. In other words, cross-border M&A decisions and also the consequential financial performance may be affected. Using a large sample of international firms between 2000 and 2019, we investigate this issue via a Difference-in-Difference(DID) approach. Our results show that introducing ETS in host countries lead to significantly less cross-border M& A deals and also lower financial performance. There are also clear evidences of cross-sectoral difTerences. In addition to the cost, we also find evidence that the establishment of carbon market can bring additional uncertainties, which contribute to the negative effects on cross-border M&A.

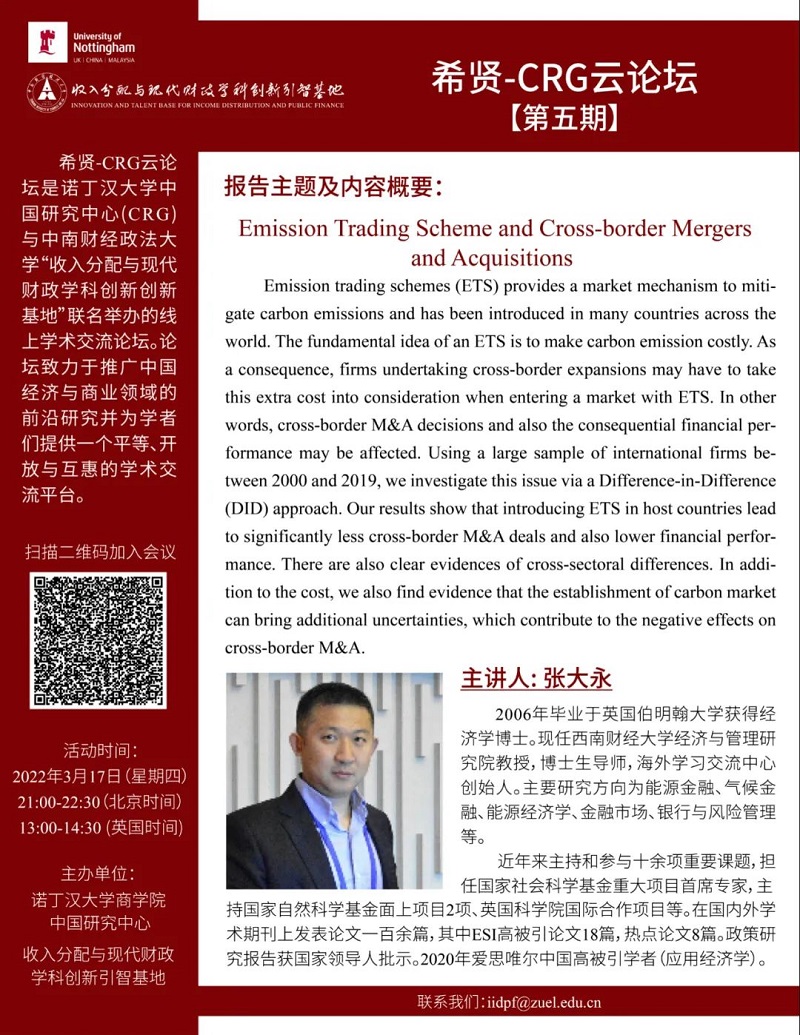

Presenter: Zhang Dayong

He received his PhD in Economics from the University of Birmingham in 2006. He is currently a professor at the Institute of Economics and Management of Southwest University of Finance and Economics, and is the founder of the Overseas Study Exchange Centre. His main research interests are energy finance, energy economics, financial markets, banking and risk management.

He has chaired and participated in over ten important projects, served as the chief expert of major projects of the National Social Science Foundation of China, chaired two projects of the National Natural Science Foundation of China and international cooperation projects of the British Academy. He has published more than one hundred papers in domestic and international academic journals, including 18 ESI highly cited papers and 8 mostly read papers. He has been approved by national leaders for his policy research reports. 2020 Elsevier China Highly Cited Scholar (Applied Economics).

Time: 17 March 2022 (Thursday) 21:00-22:30 (GMT +8) 13:00-14:30 (GMT +0)