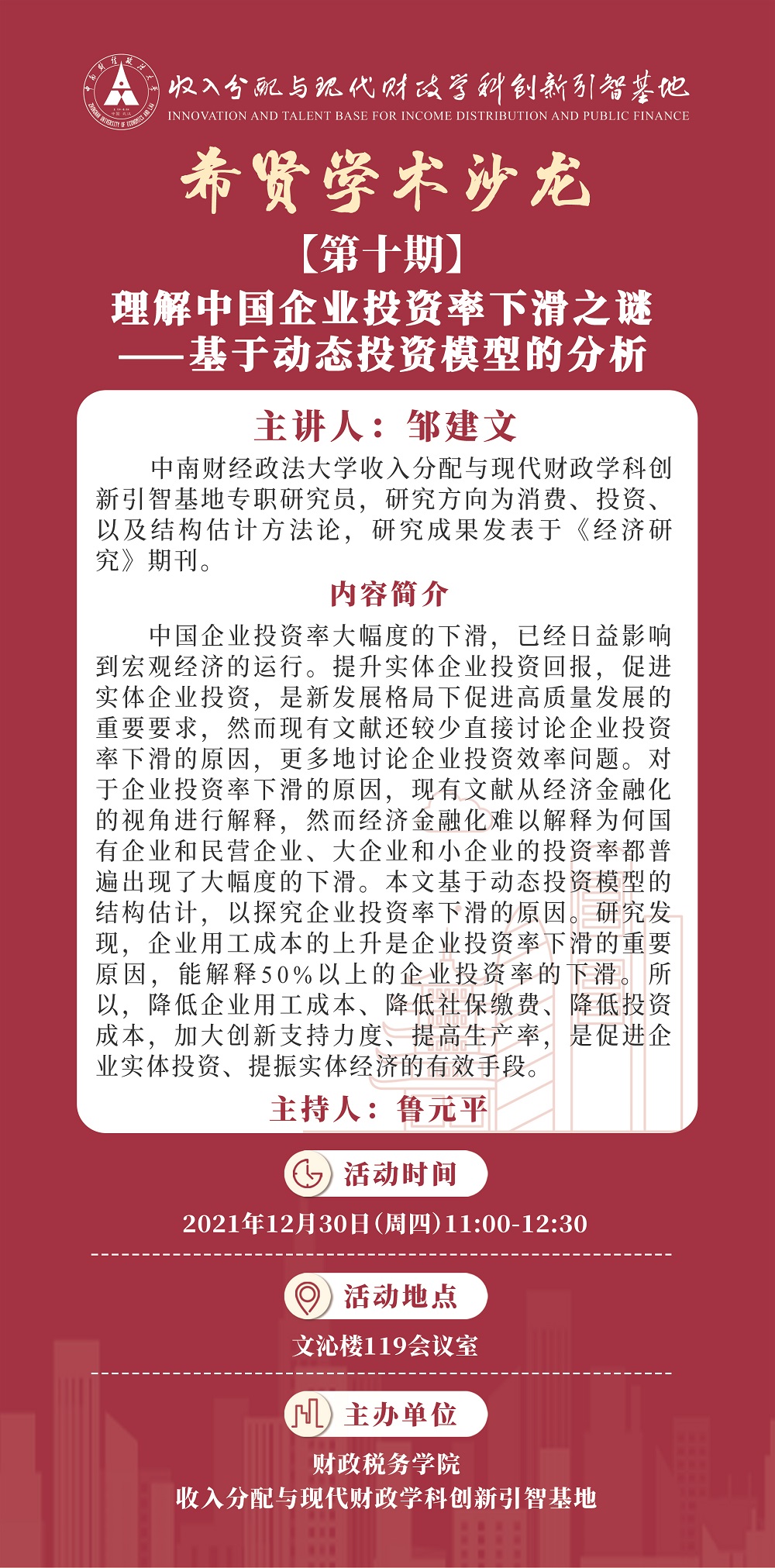

Lecture Title: Understanding the Mystery of the Declining Investment Rate of Chinese Enterprises - An Analysis Based on Dynamic Investment Models

Time: 11:00-12:30 Thursday, 30 December 2021

Venue: Conference Room 119, Wenqin Building

Moderator: Prof. Lu Yuanping9,

Presenter: Dr. Zou Jianwen

Dr. Jianwen Zou is a full-time researcher at IIDPF. His research interests include consumption, investment and structural estimation methodology.

Abstract:

The significant decline in the investment rate of Chinese enterprises has increasingly affected the operation of the macro economy. Improving the return on investment by real enterprises and promoting investment by real enterprises is an important requirement for promoting high-quality development under the new development pattern. However, the existing literature is less likely to discuss the causes of the decline in enterprise investment rates directly and more likely to discuss the efficiency of enterprise investment. The existing literature explains the reasons for the decline in enterprise investment rates from the perspective of economic financialisation, and then it is difficult for economic financialisation to explain why the investment rates of both state-owned and private enterprises, and large and small enterprises, have generally experienced a significant decline. This paper is based on the structural estimation of a dynamic investment model to explore the reasons for the decline in the investment rate of enterprises. It is found that the rise in labour costs is an important reason for the decline in investment rates, explaining more than 50% of the decline in investment rates. All, lowering corporate labour costs, lowering social security contributions, lowering investment costs, increasing innovation support and improving productivity are effective means to promote corporate real investment and boost the real economy.