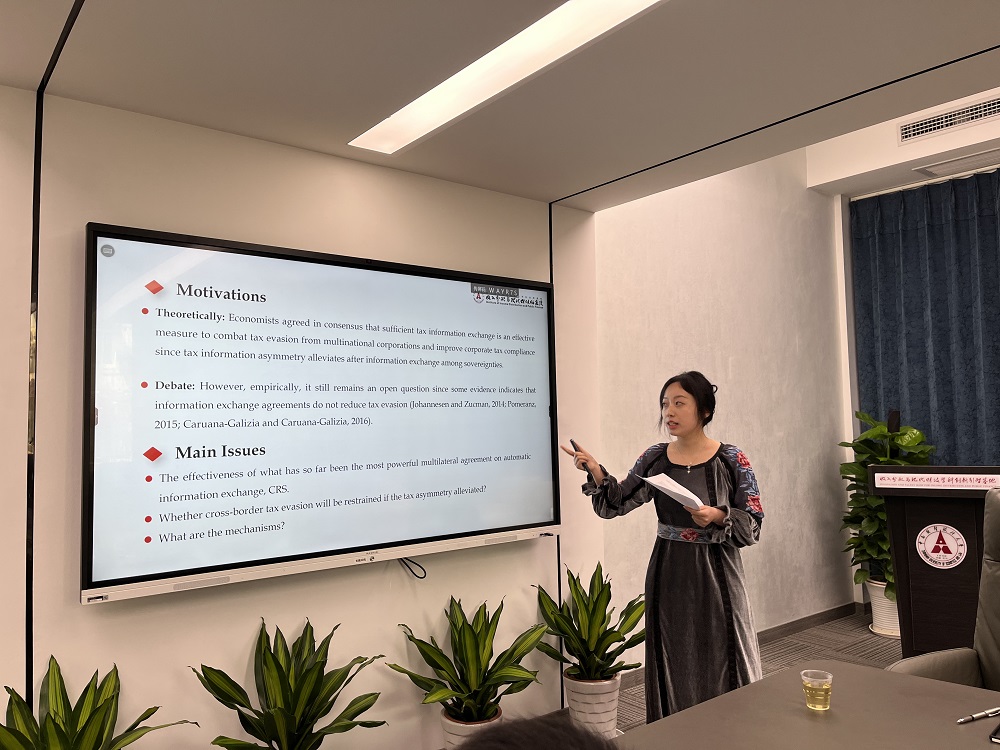

On 21 April 2022, the 13th Xi Xian Academic Luncheon, co-organised by IIDPF and the School of Public Finance and Taxation, was successfully held in Conference Room 119, Wenqin Building. Dr. Gao Sihan, a researcher at IIDPF, was the guest speaker for this academic luncheon and gave a talk entitled Does Information Exchange Matters for Cross-border Tax Evasion? Evidence from Common Reporting Standard. The forum was chaired by IIDPF researcher Dr Wan Qian, and more than thirty faculty and students, including Dr Wan Xin, Dr Zou Wei and Dr Zou Jianwen, attended the academic forum.

In today's world, the decreasing barriers to the cross-border movement of goods and factors of production have led to global economic integration and the emergence of cross-border tax evasion by enterprises. In order to promote the automatic exchange of tax information between countries, strengthen global tax cooperation to enhance tax transparency and combat the use of cross-border financial accounts for tax evasion, the OECD organisation has proposed the Common Reporting Standard (CRS), based on FATCA. Through theoretical analysis, we found that the increase in information transparency and the increase in tax administration power will lead to an increase in the marginal cost of cross-border tax evasion, thus reducing the phenomenon of cross-border tax evasion by enterprises. Using panel data of Chinese listed companies from 2012 - 2020 from the Orbis & CSMAR database, Dr Gao Sihan constructs a DID model to further explore whether the implementation of CRS can effectively mitigate corporate profit shifting and cross-border tax evasion after China's accession to the CRS agreement. The empirical results show that the effective tax rate increased significantly by 1.6% after the introduction of the first standard for automatic exchange of tax-related information on financial accounts. The increase in the effective tax rate and the reduction in tax evasion suggest that CRS has, to some extent, discouraged multinational companies from using various means of profit shifting.

Dr. Gao Sihan's presentation attracted the audience of students and teachers. During the exchange session, faculty and students interacted actively on issues such as data samples. Dr. Gao Sihan's work analyses the effectiveness of CRS at the enterprise level and makes a theoretical contribution to effectively curb cross-border tax evasion by enterprises.