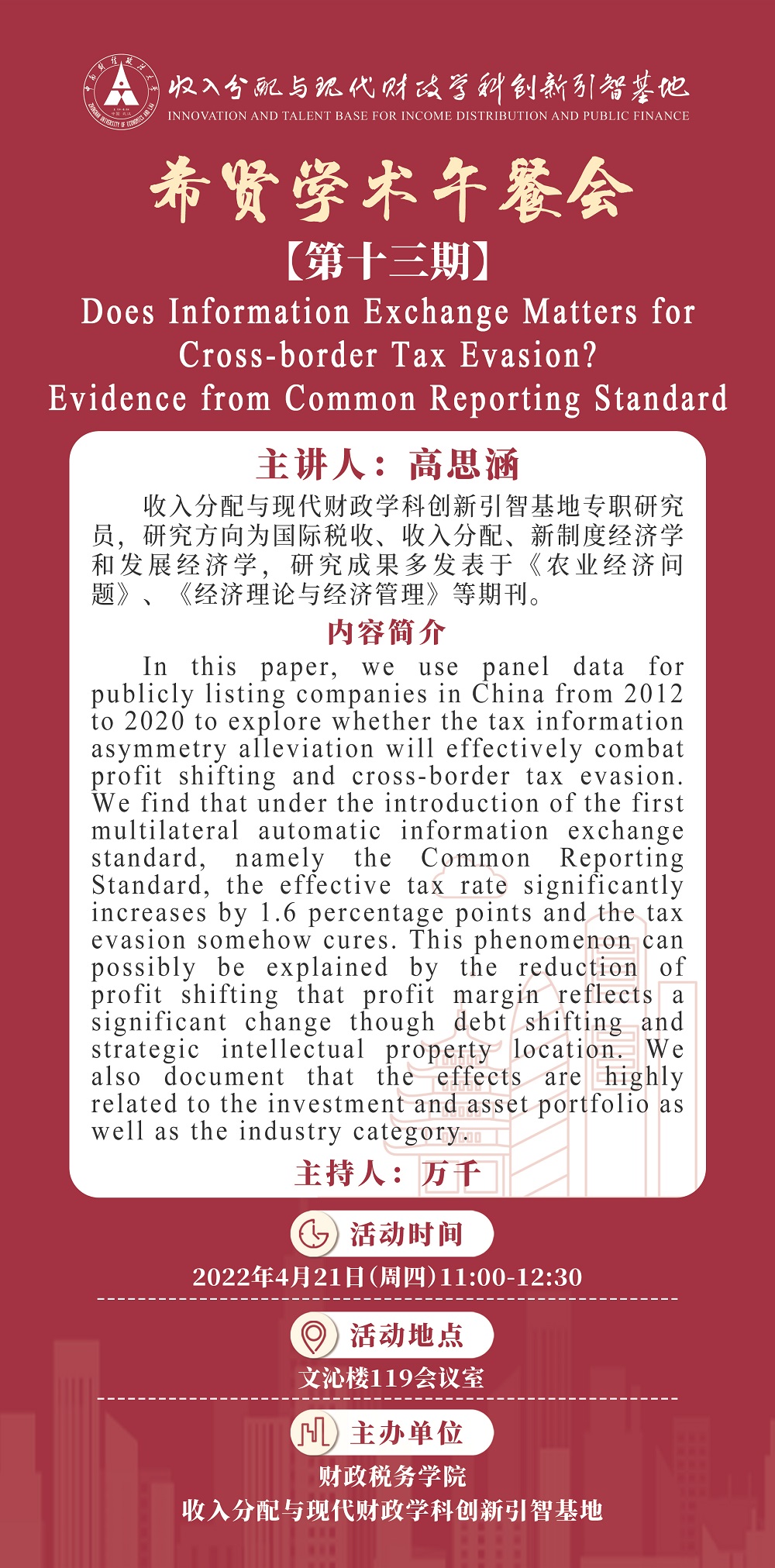

Lecture Title: Does Information Exchange Matters for Cross-border Tax Evasion? Evidence from Common Reporting Standard

Time: 11:00-12:30, Friday, 21st April 2022

Venue: Conference Room 119, Wenqin Building

Moderator: Dr. Wan Qian

Presenter: Dr. Gao Sihan

Full-time researcher at IIDPF with research interests in international taxation, income distribution, new institutional economics and development economics.

Abstract:

In this paper, We use panel data for publicly listing companies in China from 2012 to 2020 to explore whether the tax information asymmetry alleviation will effectively combat profit shifting and cross-border tax evasion. We find that under the introduction of the first multilateral automatic information exchange standard namely the Common Reporting Standard, the effective tax rate significantly increases by 1.6 percentage points and the tax evasion somehow cures. This phenomenon can possibly be explained by the reduction of profit shifting that profit margin reflects significant change though debt shifting and strategic intellectual property location. We also document that the effects are highly related to the investment and asset portfolio as well as the industry category.