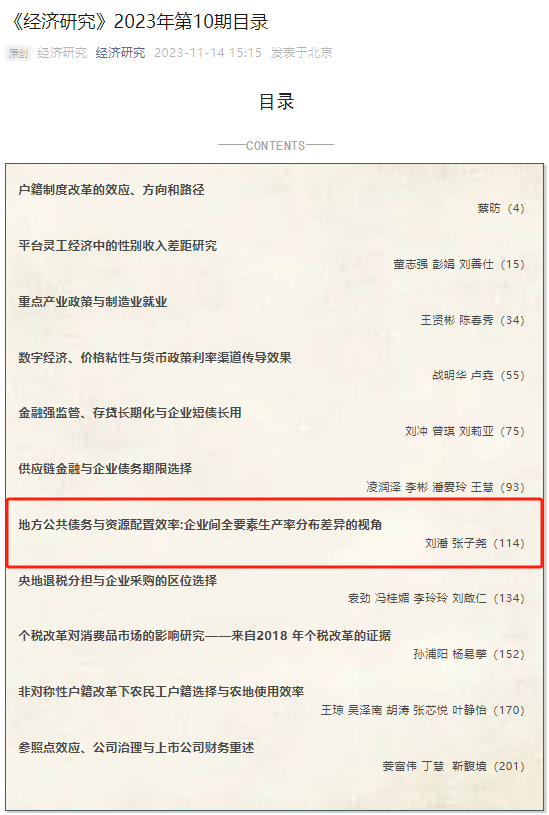

The research paper “Local Public Debt and Resource Allocation Efficiency: Analysis Based on the Distribution Differences of TFP among Firms” by researchers Liu Pan, and Zhang Ziyao from IIDPF was published in the 10th issue 2023 of Economic Research Journal, the top journal.

Abstract

China has entered a phase characterized by high-quality development, wherein the crucial ingredient for accomplishing such development lies in the augmentation of macro-level total factor productivity (TFP). The report to the 20th National Congress of the Communist Party of China explicitly emphasizes the necessity of pursuing high-quality development as the overarching task, which entails devoting effort to augmenting TFP. At the macroeconomic level, the overall level of TFP is determined by the TFP at the firm level and the efficiency of resource allocation among firms. In practice, market imperfections and government policies can both contribute to market distortions, leading to suboptimal allocation of resources among firms. Following the onset of the global economic crisis in 2008, a notable phenomenon emerged in China's economic macro-governance whereby local government financing vehicles experienced rapid growth, leading to the massive accumulation of local public debt. The analysis of local public debt serves as a significant framework for elucidating the evolution in resource allocation efficiency in China. What is the correlation between local public debt and the efficiency of resource allocation among firms, and what are the underlying mechanisms?

The study contributes in three ways. Firstly, it provides a direct answer to the crucial problem regarding the impact of local public debt on resource allocation efficiency. Additionally, it enhances and broadens the existing research on the influence of macroeconomic policies on resource allocation efficiency by using microdata from the post-2008 period. Existing literature mostly focuses on the effects of tax policies, industrial policies, and other macroeconomic policies, as well as market conditions, on resource allocation efficiency. This work aims to broaden the research scope of macroeconomic policies and the policy sources pertaining to resource misallocation. Secondly, it aims to analyze the subtle economic risks associated with China's local public debt. The existing literature mostly focuses on the immediate risks of debt default. However, given that China's economy has transitioned to a new phase of high-quality development, which necessitates improvements in resource allocation efficiency, this paper's findings offer microscopic evidence to support high-quality development. Finally, this work enhances the understanding of the relationship between government debt and its economic implications, as well as the impact of macroeconomic policies on resource allocation efficiency. The prevailing scholarly consensus suggests that the primary mechanism via which government debt affects the economy is the intensive margin. Additionally, existing literature mostly focuses on the factor market when analysing resource misallocation. However, this paper examines the effects of government debt on both the intensive and extensive margins of firms, as well as the phenomenon of resource misallocation in the product market.

This study employs the instrumental variable method to address potential endogeneity issues. The primary empirical findings indicate that the magnitude of local public debt has a substantial impact on the standard deviation of TFP within city-industries. This, in turn, results in greater resource misallocation and a decrease in resource allocation efficiency. Following a comprehensive set of robustness tests, the obtained results remain valid and robust. The mechanism analysis reveals that local public debt hinders resource allocation efficiency through two dimensions, namely the intensive margin and the extensive margin. The former one pertains to the phenomenon of squeezing local financial resources in the factor market, resulting in higher financing costs for local firms, and simultaneously widening the disparity in financing costs among firms. Specifically, the disparity in financing costs mostly manifests in the amount of assets, ownership, and employee size of firms. In the product market, the market power of firms in the infrastructure building sector and state-owned firms has increased, resulting in a widening gap in market power among firms. The extensive margin plays a crucial role in influencing the entry and exit of firms within a market, in accordance with the principle of survival of the fittest, hence impacting the overall competitiveness of the industry. Subsequent heterogeneity analysis has revealed that the impact of local public debt on resource allocation efficiency is more pronounced in regions characterized by lower levels of financial development and fiscal transparency, and in capital-intensive industries, while no significant impact is observed in labor-intensive and technology-intensive industries.

The policy implications of this study encompass the need to prioritize the economic risks associated with local public debt which hampers resource allocation efficiency. Currently, there is a pressing necessity to expedite the development and enhancement of a contemporary and accountable fiscal framework, while maximizing the benefits of a public and transparent local government bond market. Furthermore, in order to fully utilize the influential role of the market mechanism in resource allocation, it is imperative to continue reforms to develop the socialist market economy. This entails establishing a more comprehensive factor market and product market that is oriented towards market-based allocation systems and mechanisms. Additionally, it is crucial to develop a nationwide system that operates in accordance with market rules, promoting a survival of the fittest approach. In addition, the present imperative undertaking in economic system reform entails the establishment of a unified national market that is efficient and allows fair competition within the factor market and product market.

Brief Bio

Liu Pan is an Associate Professor with annual salary of Public Finance at the School of Public Finance and Taxation of ZUEL, a researcher of IIDPF, and a PhD of Economics of Renmin University of China. His main research interests are public debt and environmental economics, and his research results have been published in Chinese Social Sciences, Statistical Research, Public Finance Research and Journal of Renmin University of China. He has participated in books such as Light and Heavy: A Panoramic Perspective on China’s Tax Burden and Integrating Development and Security: A Study of Chinese Government Debt. He was awarded the second prize of the 16th Beijing Excellent Achievement Award in Philosophy and Social Science and the 5th Liu Shibai Economics Award. He has participated in several major programs of National Social Science Foundation of China, and independently chaired the Youth Project of the NSFC and the project of Hubei Social Science Fund.

Zhang Ziyao is an Associate Professor with annual salary at the School of Public Finance and Taxation of (ZUEL), a researcher of IIDPF, and a PhD in Economics of Renmin University of China (Class of 2022). His research interests is public and industrial economics, and main focuses are resource allocation efficiency, enterprise market power and productivity, fiscal policy and enterprise behaviour, etc. His research results have been published in Economic Research Journal, The Journal of World Economy, China Industrial Economics, etc. He was awarded the 7th Contemporary Economics Doctoral Innovation Project, the 7th Tan Chongtai Development Economics Scholarship, etc.