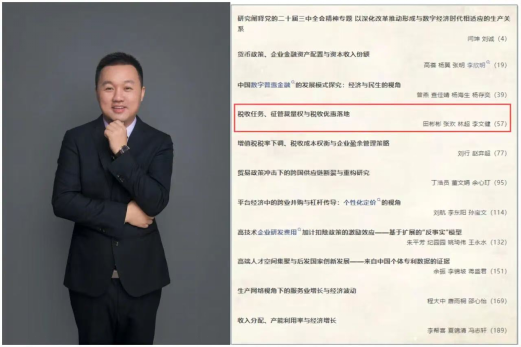

Recently, the research result titled "Tax Tasks, Discretionary Power of Tax Collection and Administration, and Implementation of Tax Incentives" jointly completed by Tian Binbin, a researcher at the Center for International Cooperation and Disciplinary Innovation of Income Distribution and Public Finance (the Center), and his team members was officially published in the top journal Economic Research Journal, issue 8, 2024. The team comprises Zhang Huan, a doctoral student at the School of Public Finance and Taxation, Zhongnan University of Economics and Law (ZUEL), Lin Chao, a doctoral student at the School of Finance, Renmin University of China, and Li Wenjian, a researcher at the School of Economics of Zhejiang University.

[Abstract] The implementation of tax incentives is directly linked to the effectiveness of tax reduction policies, making it a crucial factor to consider when designing the tax system. Existing studies focus on the factors influencing the implementation of tax incentives at the enterprise level, ignoring the potential impact of behavioral incentives in tax departments. This paper examines the impact of tax tasks, a core incentive mechanism in China's tax departments, on the implementation of tax incentives from the political economy perspective. This paper conducts a theoretical and empirical analysis of the impact of tax tasks on the implementation of tax incentives based on the national macro and micro data from 2008 to 2015. The study focuses on income tax preferences for small and micro enterprises as the primary preferential policy. The research results indicate that tax task pressure significantly inhibits the implementation of tax incentives and the discretionary power of tax collection and administration serves as a crucial institutional basis for this relationship. However, reducing this power significantly weakens the inhibiting effect of tax tasks on the implementation of tax incentives. This paper offers valuable insights into understanding the effect of tax reduction policies and the long-term reform of the tax collection and administration system.

[About the Authors]

Tian Binbin is a Distinguished Professor at the Wenlan School of Business at Zhongnan University of Economics and Law (ZUEL), a researcher at the Center, a doctoral supervisor, a candidate for the National Talent Project, and Young Top-notch Talent in Hubei Province. His research interests include public finance, empirical taxation, and development economics. His research results have been published in authoritative Chinese and English journals such as Economic Research Journal, Journal of Management World, The Journal of World Economy, China Economic Quarterly, and Journal of Economic Behavior & Organization. He has led several provincial and ministerial projects such as the General Program and Youth Program of the National Natural Science Foundation of China, and the Humanities and Social Sciences Fund Project of the Ministry of Education. He has won many honors such as the first prize of the Hubei Province Social Science Outstanding Achievement Award, the first prize of Outstanding Achievements in Tax Research of the Chinese Tax Institute, and the Best Paper Award at Camphor Finance Conference. He is also a director at the Young and Middle-aged Tax Research Association of the Chinese Tax Institute.

Zhang Huan is a doctoral student enrolled in 2023 at the School of Public Finance and Taxation, ZUEL. Her research focuses on fiscal and taxation theory and policy, with an emphasis on issues such as tax collection and administration, fiscal and taxation policies, and enterprise behaviors. Her research results have been published in authoritative journals such as Economic Research Journal, Journal of Quantitative & Technical Economics, and Journal of Tax Research.