The 73rd Xi Xian Forum, sponsored by the Center for International Cooperation and Disciplinary Innovation of Income Distribution and Public Finance at the Zhongnan University of Economics and Law (ZUEL) and the university's School of Public Finance and Taxation, was successfully held on April 9, 2025, in Wenqin Building's Conference Room 119. Lei Jian, a 2023 full-time doctoral student jointly trained by the Research Institute of the People's Bank of China and the PBC School of Finance (PBCSF), Tsinghua University, was the keynote speaker at this academic forum. He delivered a special academic speech on how China's structural monetary policy promotes the income growth of farmers. The forum was moderated by Zou Jianwen, a researcher at the Center for International Cooperation and Disciplinary Innovation of Income Distribution and Public Finance, and attended by over 10 participants, including the researcher Lin Jiada from the Center.

In his speech, Dr. Lei Jian pointed out that the agricultural re-lending policy, launched by the People's Bank of China as a long-term, structural monetary policy tool, has played a significant role in increasing farmers' incomes and supporting rural economic development. He emphasized that building a macroeconomic governance system with Chinese characteristics necessitates combining the innovative practice of monetary policy tools such as agricultural re-lending with the theoretical foundation of Marxist political economics, modern economic analysis tools, and the innovative guidance of Xi Jinping's thought on economy.

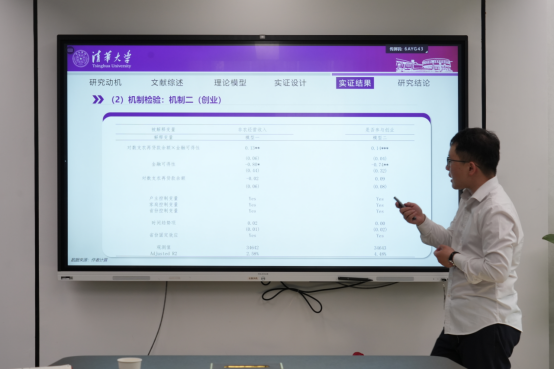

Dr. Lei Jian systematically elaborated on the four primary functional mechanisms of the re-lending policy for agriculture in macroeconomic governance: First, increasing the source of funds for farmers and agricultural businesses by improving loan accessibility; second, reducing the financing burden of farmers and agricultural businesses by lowering loan interest rates; third, by guiding the flow of funds, supporting the development of agriculture and other specific segments; fourth, promoting stable economic growth by facilitating the coordinated drive of consumption and income. He noted that the re-lending policy for agriculture has, over the past 25 years of development, gradually become an essential component of China's macroeconomic governance system.

In addition, Dr. Lei Jian also addressed the challenge of policy coordination in macroeconomic governance. He examined the recent coordination processes among China's monetary, fiscal, and industrial policies. He found that the policy framework is continuously being refined and expanded. Lei Jian pointed out that ongoing practices such as deepening financial system reform and developing a multi-level capital market are charting a new course for macroeconomic governance, that is, improving total factor productivity through institutional innovation and policy coordination, thereby enabling a transformation in development momentum.

This academic forum showcased the notable outcomes of the agricultural re-lending policy in increasing farmers' incomes and supporting rural economic development, providing valuable insights for future innovation in macroeconomic governance. The teachers and students present participated in discussions, engaging in wide-ranging exchanges on topics such as the effectiveness of the agricultural re-lending policy, to what degree the policy can meet farmers' financing needs, and the policy's role in promoting rural revitalization and new urbanization.

Guest Profile

Lei Jian is a 2023 full-time doctoral student jointly trained by the Research Institute of the People's Bank of China and the PBC School of Finance (PBCSF), Tsinghua University. He holds Dual Bachelor's Degrees in Mathematics and Applied Mathematics and Economics and a Master's Degree in Computer Technology from Beihang University. In March 2021, he joined Micro Connect Group, a global leader in the "revenue sharing" model for small and micro enterprises. In October 2021, he was promoted through five consecutive ranks and served as the Director of Industry Intelligence and the Director of Financial Research. He has published several papers in journals such as Finance and Economics, New Finance, Statistics & Decision, and Finance Research Letters. In addition, multiple papers by him are under peer review by Management Science, Journal of Financial and Quantitative Analysis, and Review of Finance. His research interests include macro-finance, machine learning (ML) asset pricing, and investment and financing for small and micro enterprises.